Benefits Based On Performance™

There's really no desire to reduce the cost of health care, really?

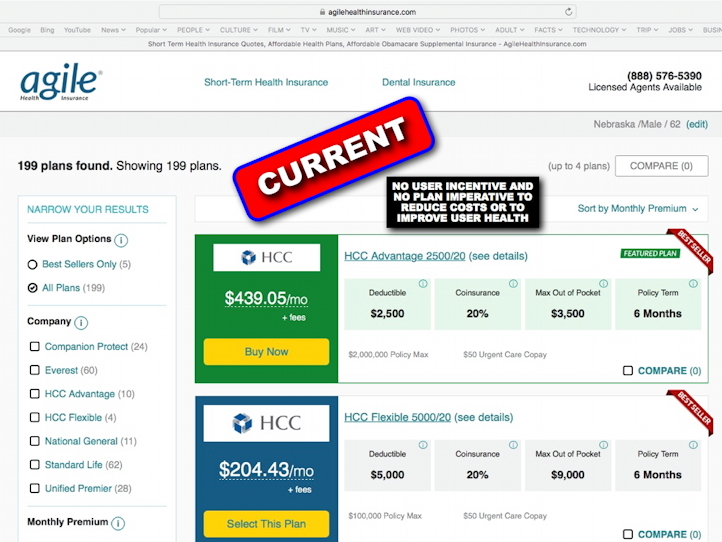

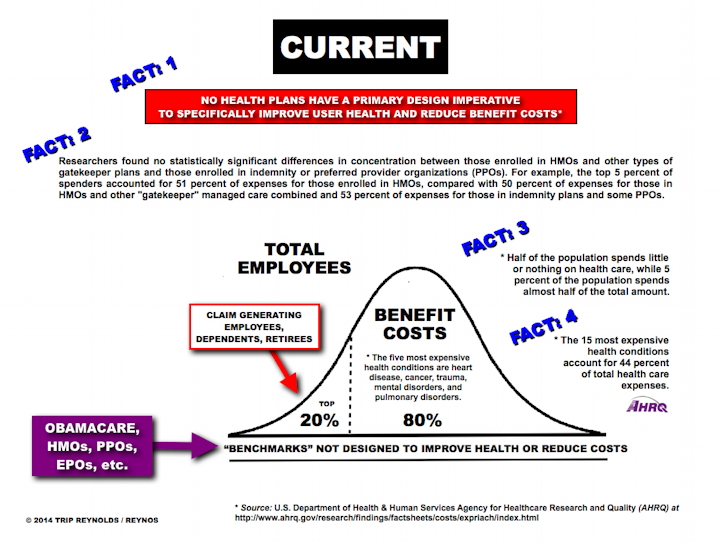

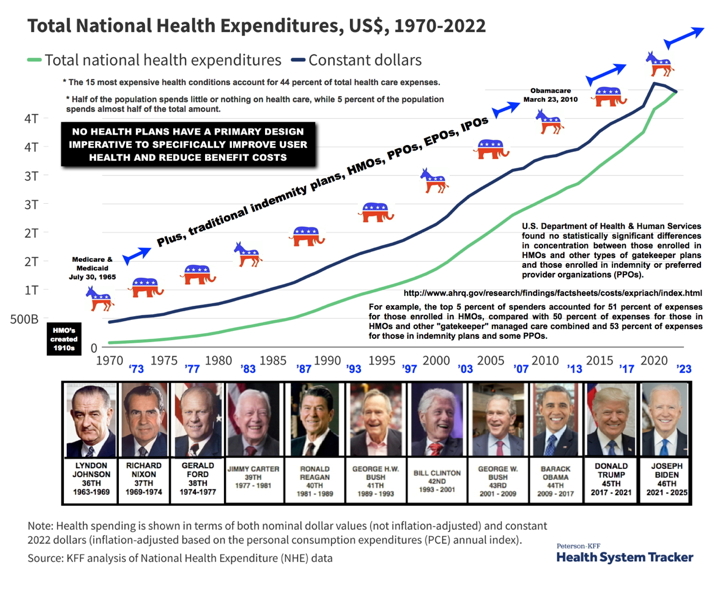

And that's the real problem. Health care systems (traditional indemnity plans, HMOs, PPOs, EPOs, IPOs, Medicare, and the Affordable Health Care Act), are not designed to improve health, or to reduce the cost of health care; but are designed to respond or provide services primarily or only in the event of a claim, which includes health prevention and wellness programs.

The primary "business model" for all health care systems is: (a) to generate revenue streams (which includes the perpetual collection of insurance premiums) "after" the occurence of a health event," and subsequently lock the patient into a reoccuring necessity of perpetual medical care; and (2) to nurture whether directly or indirectly, and in concert with the food processing and fast food industries, political and governmental bureaucracy, and the pharmaceutical industry, a perpetual feeder population of morbidly overweight, obese, sick, and otherwise unhealthy people to sustain existing revenue steams. That's the business model.

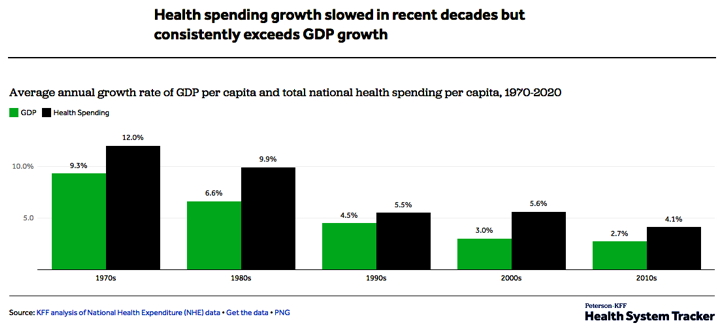

With the cost of health care constantly exceeding GNP, plus the numerical limits and drop in per capita productively of the feeder groups, ultimately this business model is not sustainable.

CLICK ABOVE IMAGE TO ENLARGE

Thirty-(30) years ago I independently conceived a proprietary health benefits delivery system that unlike traditional indemnity plans, HMOs, PPOs, EPOs, IPOs, Medicare, or even the Affordable Health Care Act (Obamacare):

1. reduces both employer and employee health care costs by 25% within twelve months of implementation, and produces another 25% reduction within the next 18 months or less (and I can prove it!);

2. continues to produce on-going savings - and with absolutely no reduction in the quantity of care or quality of health benefit services;

3. most importantly, dramatically improves the health of all plan participants; and

4. captures and indexes health benefit savings to various financial instruments!

Consider the following employer response when given the opportunity to dramatically reduce the cost of heatlh care and simultaneously improve member health:

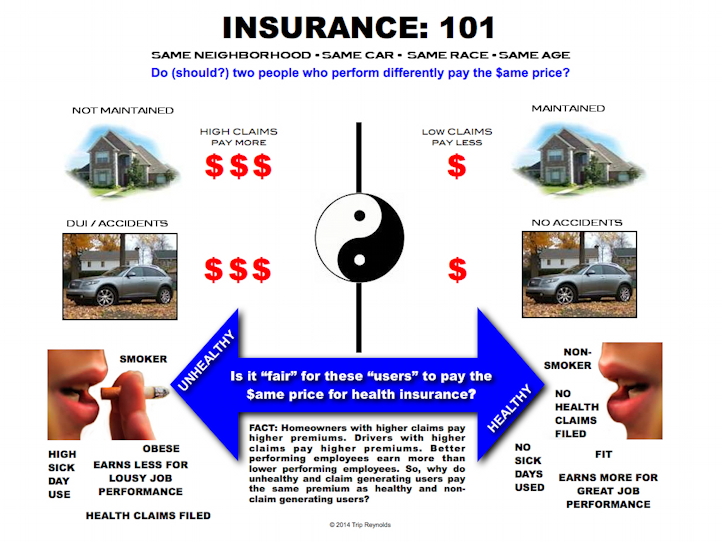

Except when it comes to health care, the typical business model for insurance is very simple:

Again, except when it comes to health benefits insurance, the extremely well-known, well-documented actuarial facts that define the "risk" for insuring unhealthy and unfit insureds is not used to define the full character and scope of health benefits insurance. There's absolutely no correlation between paying a higher deductible with better access to health care, or with higher quality of healthcare from medical and clinical staff, or with better fitness and well-being.

QUESTION:

So, if you're a member of that constantly shrinking population of healthy and fit people, other than paying a lower monthly premium, what exactly are you getting by paying a higher deductible?

RESPONSE: You're paying for the cost of health care for the overwhelming majority of illnesses and diseases that are preventable by people who are "insured" but unhealthy, unfit, morbidly overweight and obese, etc., and who expect inequitably designed employer health benefit plans to pay the majority of their costs for health benefits.

Again, the selection of any specific health benefits delivery system doesn't matter (traditional indemnity plans, HMOs, PPOs, EPOs, IPOs, Medicare, or the Affordable Health Care Act / Obamacare), they all function with the same level of statistical mediocrity:

The concentration of health care spending appears to be extremely concentrated at the top in commercially-insured cohorts. A very few individuals consume a disproportionate amount of health care dollars. As can be seen in Table 4, less than 1 out of every 200 people account for 20% of all the medical claims paid.

Less than 0.5% of the population expends 10% of the dollars. This concentration is very consistent across the three periods studied.

In contrast, between 14% and 15% of commercially insured members have no medical claims in a given year. When pharmacy claims are included, the number of people with no spending drop to 11–12%. The numbers do not tell us if these are individuals who are very healthy and truly consume no medical care, or they obtain care through one or more other channels that do not generate an insurance claim in the Truven database (such as out-of-pocket spending, care at workplace clinics, government/VA clinics, or other sites that do not bill insurance.)

Considering recent medical claims in commercially insured populations, 85% of these dollars were spent on 20% or 1/5 of the population; and conversely, the remaining 15% of the dollars were spent on 80% of the population.

In Medicare populations, 81% of these dollars were spent on 20% or 1/5 of the population; and conversely, the remaining 19% of the dollars were spent on 80% of the population.

• 15–18% of individuals had no medical claim paid in a given year

• This distribution has been very consistent year to year in the 3 years studied

• Adding pharmacy spending to the commercial analysis moved the cost distribution modestly to the left.

Source: “The 80/20 Rule” Is it still true? And what can it tell us about Population Health in 2018 and beyond?

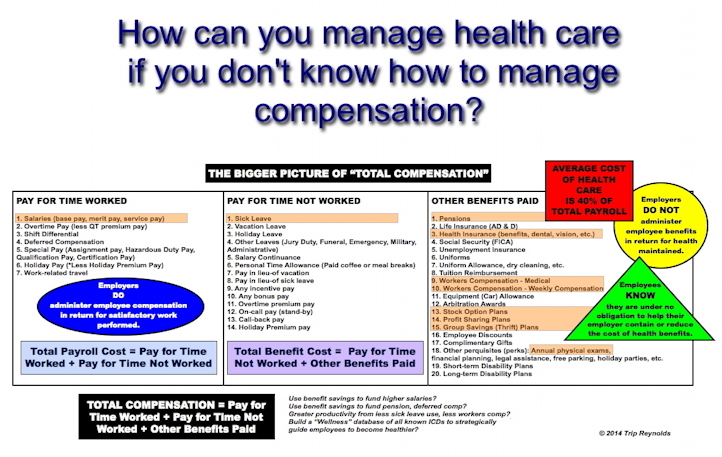

Unfortunately, most employers do not design and manage health benefits with the entire "big picture" of total compensation.

CLICK ABOVE IMAGE TO ENLARGE

THE BOTTOM LINE: In summary, pre-claim generating employees, whether healthy or not, expect inequitably designed employer health benefit plans to pay the majority of costs for health benefits. You got that?

Conversely, my proprietary health benefits delivery system:

1. Significantly advanced beyond current state-of-the-art health care delivery systems;

2. A giant leap in health benefits administration and data management;

3. The first real-time, total-comp solution to establish compensable measures between all employee related expenses;

4. Uniquely designed to reduce health care expenses with absolutely no corresponding reduction in the quantity or quality of health care services;

5. An original solution that phenomenally empowers employees to seize control of both the state of their health and the cost of their health care (it's cheaper!);

6. An original solution that finally puts the design and administration of health benefits plans back under the control of employers - instead of profit seeking/revenue oriented health carriers (HMO, PPO, EPO, POS, IPO, indemnity, Obamacare, etc.).

7. An original solution that finally stops the perpetual increase in health expenditures!

CLICK ABOVE IMAGE TO ENLARGE

To request the full (confidential) presentation, please click click here.